Following the assignment of receivables and until their collection, the Supplier may receive advance payment as a percentage of the receivables value, thus converting its receivables into cash to enhance liquidity

Improve your cash flow using your company's accounts receivable

Factoring

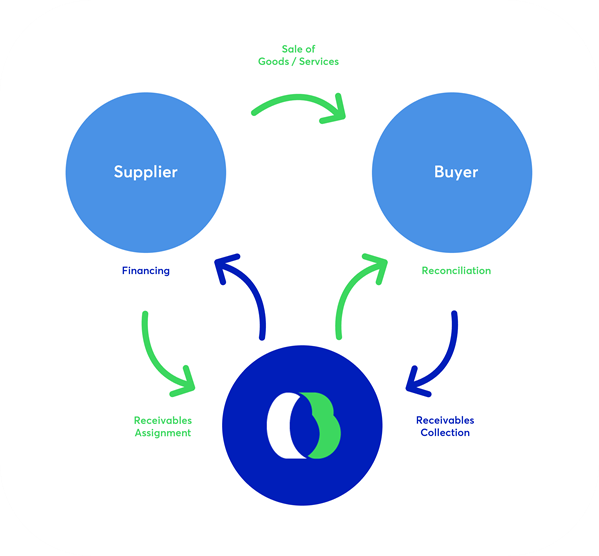

Factoring is the contractual relationship between a Supplier and a specialized financial intermediary (Factor), in the context of which the Supplier assigns to the Factor all or part of its accounts receivable against one or more Buyers.

It is a financing tool that businesses use to quickly raise working capital and improve their cash flow without the involvement of traditional bank lending. Factoring is linked to the sales of the Suppliers and their collection φρομ the Buyers.

Factoring in Greece is governed by Law 1905/1990 and is provided by credit or financial institutions supervised by Bank of Greece.

Target Audience

It is offered to small, medium and large enterprises (Suppliers) that sell products or provide services on short-term credit to their Buyers, with repetitive or one-off purchasing behavior.